Advancing web3 communication strategies for cryptocurrency projects and digital asset firms: The need for enhanced messaging in the blockchain space

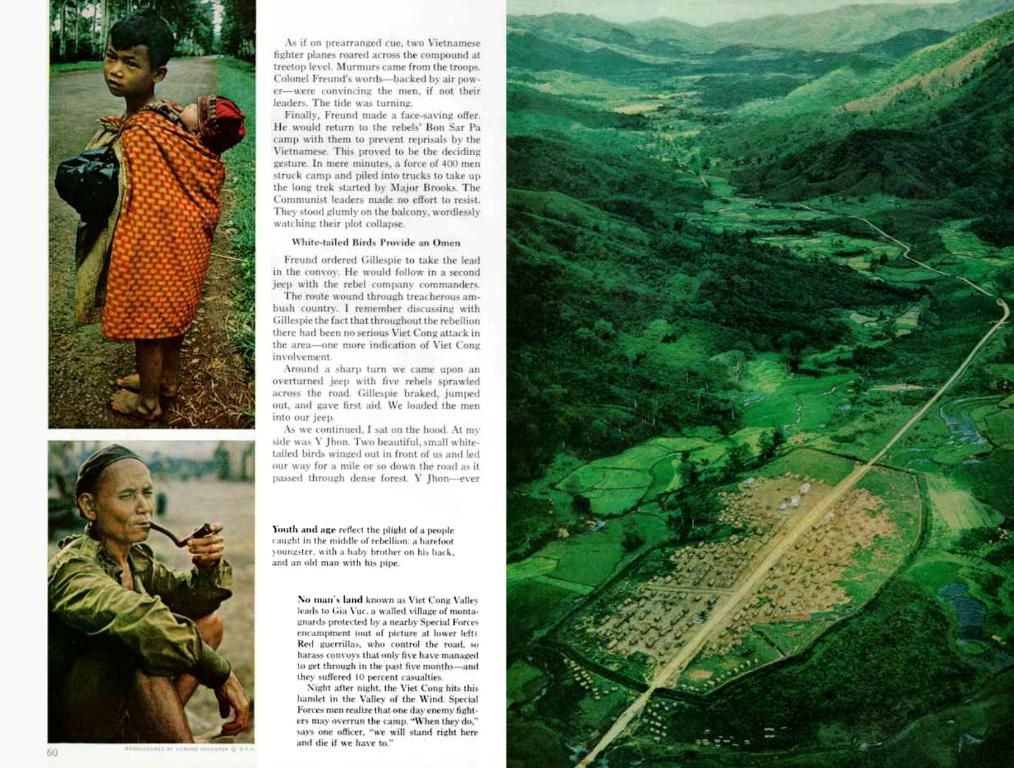

During Paris Blockchain Week, a question echoed in a packed hall: "GM, GM. You're just a Crypto Bro, right?" After being recognized following an interview with the founder of a favorite project, the question held more weight than the speaker likely intended. It was about the perceived identity of the web3 professional, and the evolving nature of the industry.

Dressing in smart casual attire, the author felt more connected to the industry than ever before. Many colleagues pursuing careers within the industry struggle with defining a modern web3 image, balancing the industry's informal roots and the need for a polished, regulator-friendly appearance. In recent times, the focus of the author's team has been on helping founders clean up their image, repositioning teams from crypto projects to digital asset companies, and using simpler, more universally understood language to explain blockchain technology.

As the crypto landscape matures, it is shedding its chaotic past, evolving into something more structured. Cryptocurrencies, once referred to as such by politicians, bankers, and institutions, are now increasingly called 'digital assets.' This terminology, defining the next phase of the industry, is indicative of efforts to gain legitimacy and clarity in regulations.

Regulatory bodies, such as the U.S. House and Senate, are starting to define the rules more clearly with acts like the STABLE and GENIUS Acts, creating a comprehensive regulatory framework for stablecoin issuers in the U.S. These initiatives, along with increased institutional interest in cryptocurrencies, are paving the way for a more mainstream ecosystem. Coinbase becoming the first crypto-native company listed on the S&P 500, BlackRock launching a Bitcoin ETF, and political debates around crypto policy in public forums all testify to the industry's growing presence.

However, communication strategies in the crypto industry have yet to match its rapid evolution. Projects are often short-termist, disregarding annual or even quarterly communication strategies, focusing on hype rather than long-term development and brand building. In contrast, traditional industries have spent decades honing their communication practices.

The key to gaining mainstream credibility, the author suggests, is to abandon the shortsighted focus on hype and instead prioritize a shift towards clear, focused messaging. Embracing a more structured approach to messaging can help projects establish long-term success, attracting both the institutional and retail investors increasingly interested in solving real-world problems with blockchain technology.

The crypto industry's cultural aspects should not be discarded entirely; instead, it is crucial to learn how to communicate with various audiences, including developers, investors, regulators, and everyday users. The fragmented nature of the industry necessitates versatile messaging that adapts to the target audience's needs.

Unfortunately, many communication agencies serving the industry may be part of the problem. While web3-native agencies are well-versed in the technology, they often lack strategic rigor and polish needed by institutional clients. Conversely, traditional PR firms, with their years of experience dealing with boardrooms and blue chips, may struggle with basic blockchain concepts. Misaligned messaging should be addressed to promote clearer, more effective communication in the crypto space.

In summary, as the crypto industry evolves, it must prioritize clear, focused messaging to garner mainstream credibility and adoption. Moving away from memes and hype towards a more structured approach will enable projects to establish strong, sustainable growth and win the trust of diverse audiences.

- The question of a web3 professional's identity became evident during Paris Blockchain Week, as one was mistakenly labeled as a 'Crypto Bro.'

- The author's team has been working on re positioning crypto projects as digital asset companies and using easy-to-understand language for blockchain technology.

- Coinbase, listed on the S&P 500, and BlackRock's Bitcoin ETF are evidence of the industry's growing presence and increasing mainstream acceptance.

- Communication strategies within the crypto industry have yet to match its rapid evolution, with many projects focusing on hype rather than long-term development and brand building.

- To achieve mainstream credibility, the author suggests adopting a more structured approach to messaging, which can attract institutional and retail investors interested in addressing real-world problems with crypto technology, while still maintaining a connection to the industry's cultural roots.