Riding the Bull Wave: Bitcoin's Long-Term Bullishness Explained

Bitcoin mirrors 2021's peak performances, yet this time, the significant Bitcoin holders (whales) exhibit divergent strategies.

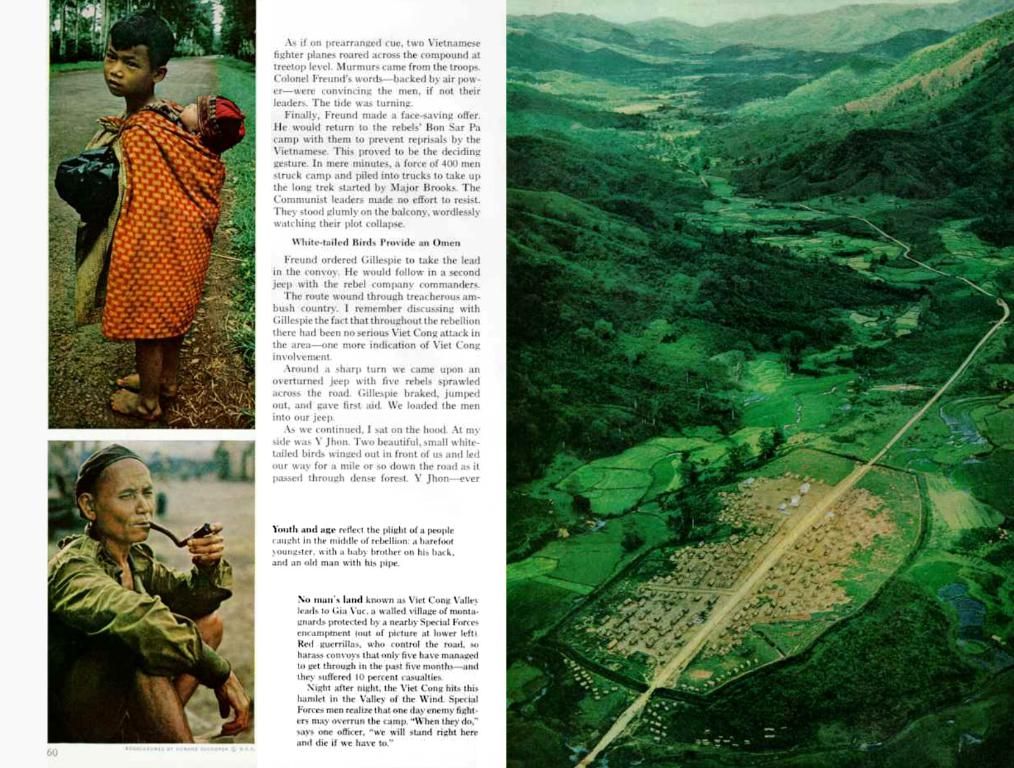

Bitcoin [BTC] investors are keeping their faith in the cryptocurrency's continued bullishness, even as it surges above the $100k mark. The buzz about BTC on social media might be low, as indicated by Google Trends, but the on-chain data paints a different picture.

Source: Axel Adler Jr on X

One such clue is the Bitcoin Exchange Flow. Since March, persistent net outflows have been the norm, with around 3.6K BTC leaving exchanges daily - a clear sign of investor confidence.

Reasons to Bet on Bullishness

Source: Adler Insights

The negative Exchange Netflow isn't the only positive signal. Short-term holders have also cut back on their profit-taking. According to the Short-Term Holder Profit to Exchanges metric, profit flows saw a sharp decline over the last two weeks. When BTC first hit around $11k, exchange profit flow amounted to 49.5k BTC. As the price hovered around the $108k mark at the end of May, the spikes on the chart reduced from 32k BTC to just 3.4k BTC by early June - a sign that short-term sellers have run dry, even as BTC trades around the $105k mark.

Meanwhile, long-term holders are stockpiling BTC. Starting in April, the 30-day Net Position Change flipped positive, with a net gain of 535K BTC. This indicates that whales and large investors stopped selling BTC and began buying instead, likely in anticipation of further growth.

Similar trends were observed in October 2023 and September-October 2024, which were followed by swift rallies. It's possible we could see another rally soon.

What Does the Future Hold?

While short-term volatility is to be expected, the long-term outlook for Bitcoin remains bullish. On-chain analysis suggests a bullish outlook for Bitcoin, with indicators such as the "cleanest trend indicator" showing potential for further growth[3].

Comparisons to previous cycles suggest that Bitcoin is primed for a similar cycle top run, potentially reaching prices upwards of $200,000 by the end of 2025[3]. The Fear & Greed Index indicates a "greed" sentiment, signaling a continued belief in Bitcoin's upward trajectory[5].

Analysts remain optimistic about Bitcoin's potential for significant price increases throughout 2025, driven by fundamental and technical factors[2][3]. So, buckle up for the exciting ride ahead!

- The Bitcoin Exchange Flow, since March, consistently shows net outflows with around 3.6K BTC leaving exchanges daily, demonstrating investor confidence in the cryptocurrency.

- In contrast to short-term holders' reduced profit-taking, as indicated by the Short-Term Holder Profit to Exchanges metric, long-term holders have been stockpiling BTC, with a net gain of 535K BTC since April, indicating an anticipation of further growth.

- Comparisons to previous cycles suggest that Bitcoin may be headed for a similar cycle top run, potentially reaching prices upwards of $200,000 by the end of 2025, as supported by on-chain analysis and the Fear & Greed Index.