Ethereum Value Examination: What Comes Next for ETH following climbing to $1,800 Barrier?

Ethereum's value took a prominent leap, bouncing back mightily at the critical $1.5K support point. With a stiff resistance range at $1.8K looming, the digital asset is poised for a brief period of consolidation before potentially bursting through this barrier.

Technical Gazing

By Shayan

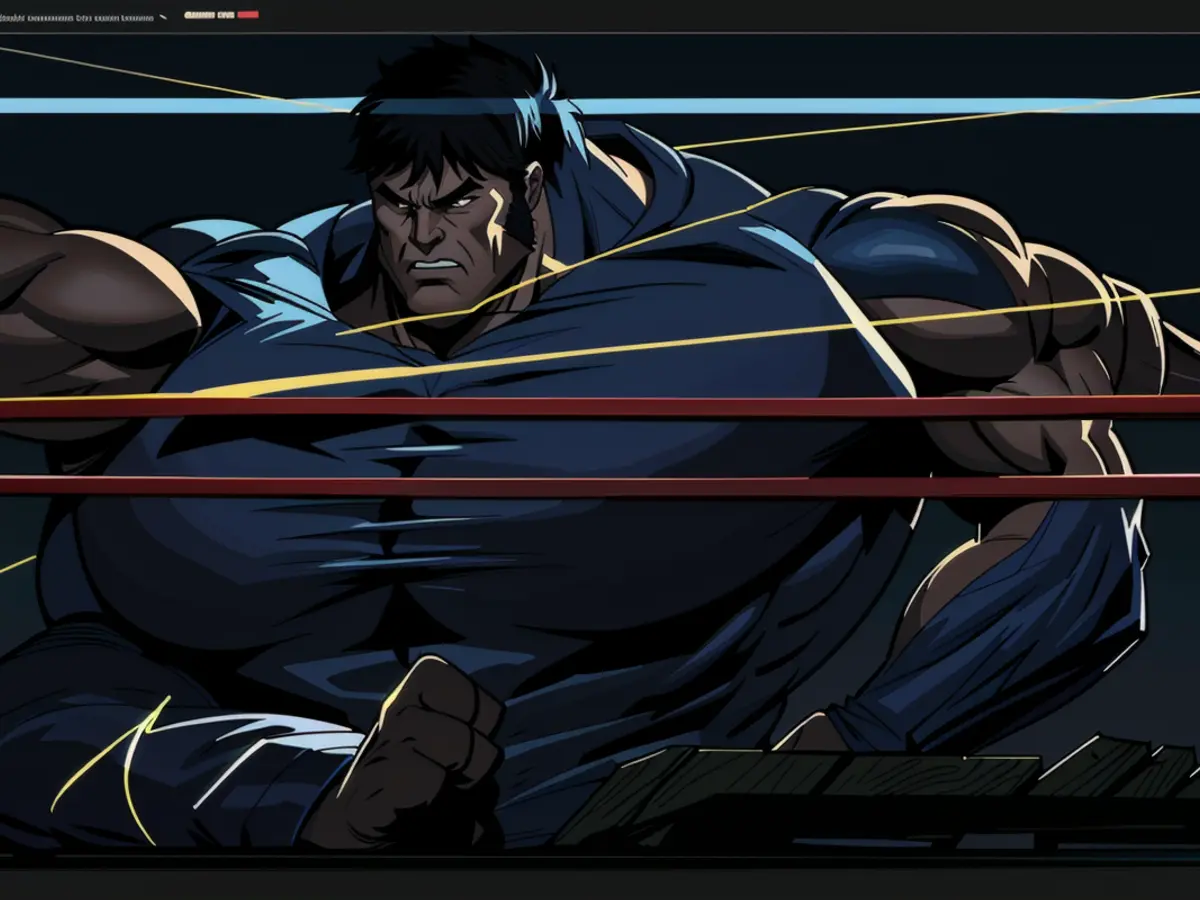

The Day-to-Day Snapshot

Following a lengthy phase of muted price fluctuations and dormant market activity around the decisive $1.5K long-term support area, Ethereum witnessed a swell of buying interest, triggering a bullish comeback. This wave of demand has pushed the price towards the significant $1.8K resistance zone. This region happens to line up with an important order block, where the top dogs often place their orders, magnifying its significance.

The action at this level is absolutely pivotal: a triumphant breakout above $1.8K could confirm a bullish reversal, kickstarting the journey towards the $2.1K target. Nevertheless, a short-term consolidation around this resistance band is expected before a decisive move transpires.

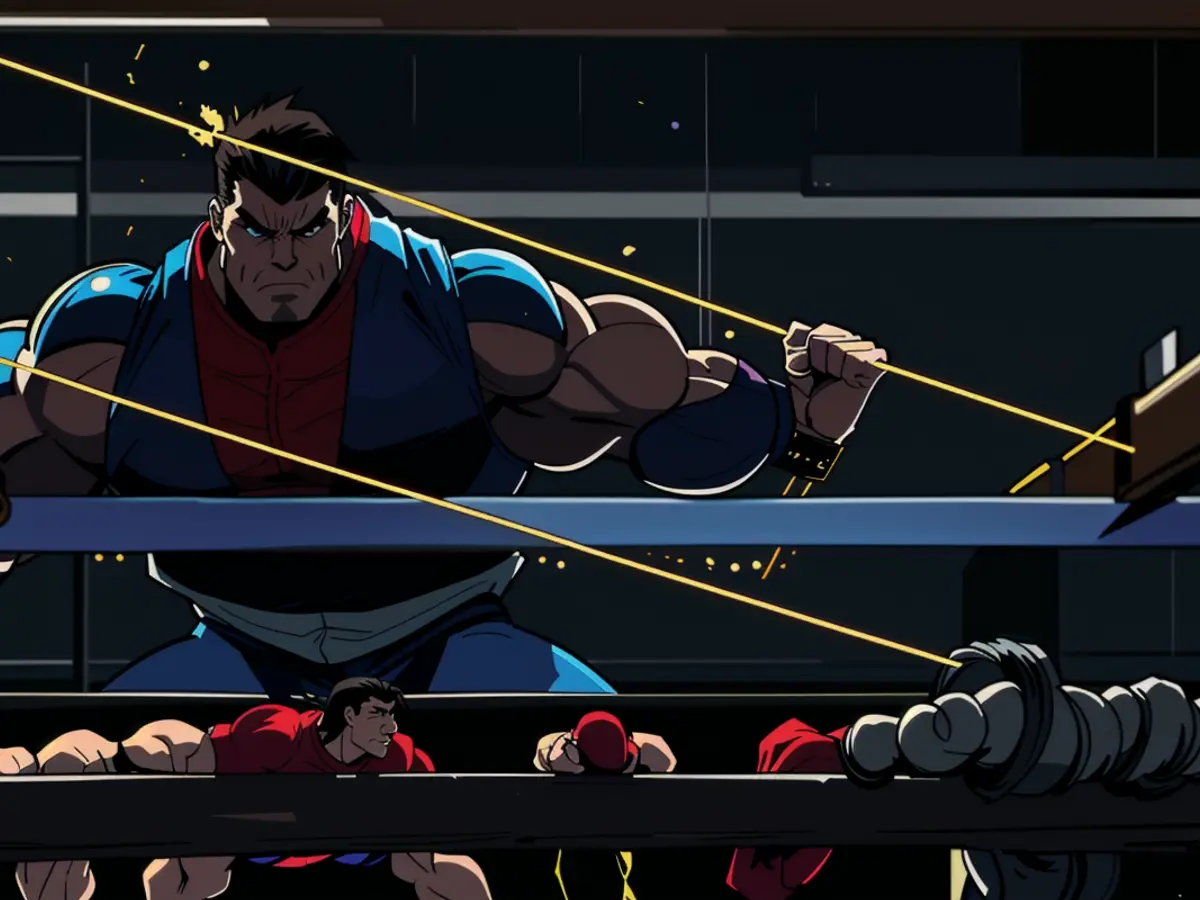

The 4-Hour Lens

On the small timeframe, Ethereum's previous tight-range consolidation was snapped by a heavy influx of buyers, leading to a powerful breakout above the downward sloping channel. This breakout was harmonized with robust bullish momentum, propelling the price towards the crucial $1.8K resistance zone.

This region corresponds with Ethereum's prior swing lows, making it a sturdy supply area. Consequently, a short-term consolidation at this level is in the cards until either demand or supply pressure determines the next direction. A bullish breakout above $1.8K would pave the way for the $2.1K range to be the subsequent target for buyers.

Mood Meter

By Shayan

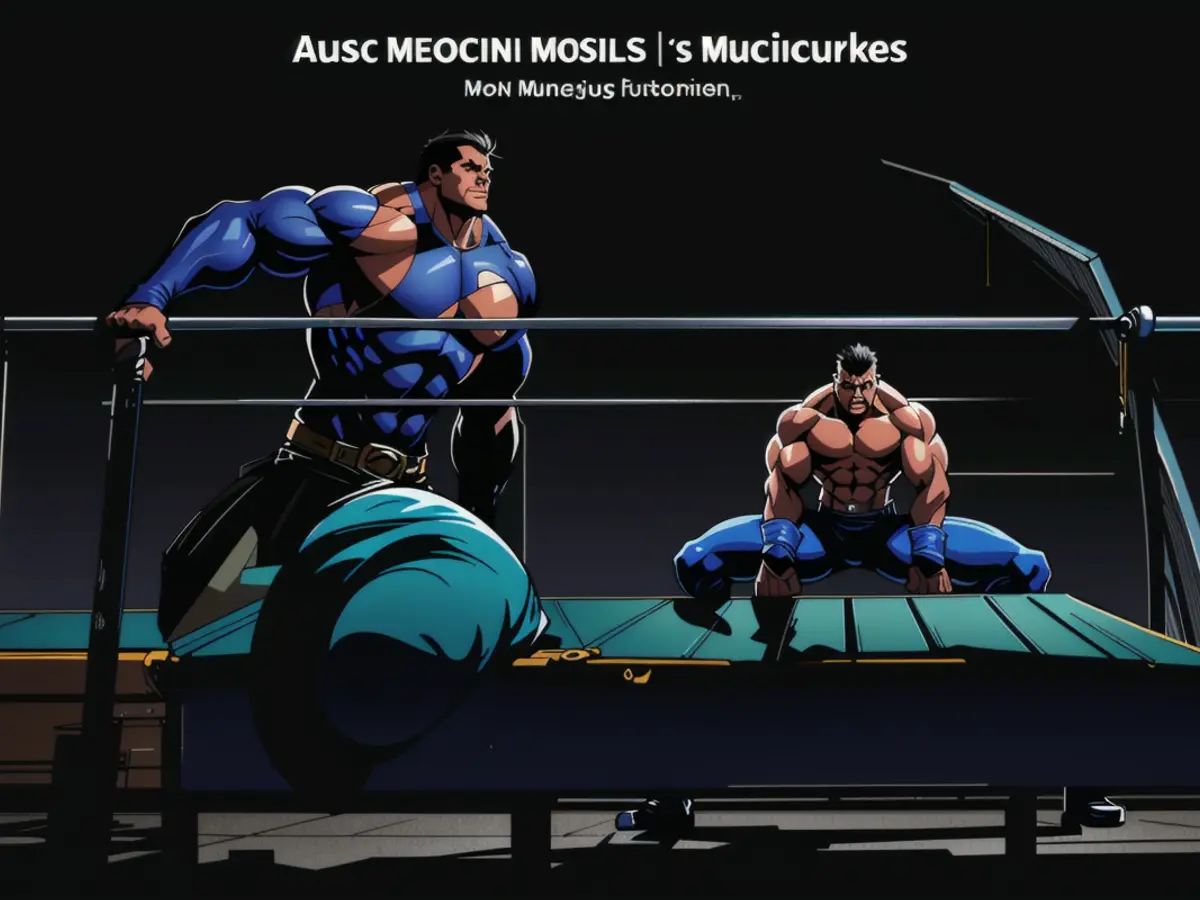

The funding rates metric serves as a valuable sentiment gauge in the futures market arena. A holy grail of insights into Ethereum's recent price pop, it reveals its driving force. In a nutshell, healthy and stable bullish trends are often accompanied by rising funding rates, signifying an influx of buyers both in the perpetual futures and spot markets.

As it stands, funding rates are merely holding steady against any appreciable rise. This suggests that Ethereum's recent surge has primarily been fueled by spot market buying rather than futures market speculation. To solidify this budding bullish trend and make it persist, the funding rates metric needs to start ticking upward, reflecting surging confidence and aggressive buying in the futures market as well.

Binance Free $600 (our exclusive offer): Clink on this link to create a new account and collect a $600 welcome bonus on Binance*Full details*LIMITED OFFER for our readers at Bybit: Click on this link to sign up and dive into a $500 FREE position on any coin!Crypto chartsEthereum (ETH) Price Facebook Twitter LinkedIn Telegram**

Data Enrichment:

In essence, the current surge in Ethereum's price is mirroring mixed sentiments tinged with optimism, balancing short-term resistance against emerging bullish momentum. Here's a quick overview:

Short-Term Actions

- April 26 Hike: ETH surged 4.2% to reach $3,282 (CoinMarketCap), owing to a 35% explosion in trading volume ($1.8B on Binance) and a 12% increase in active addresses[1].

- Resistance Quandary: While previous data from April 25 had resistance at the 50-day SMA ($1,812)[2], the April 26 rally significantly exceeded this, indicating possible discrepancies in resistance levels across timeframes or data sources.

Key Technical Elements

- Ichimoku Cloud: Recent revelations highlight a bullish convergence in the conversion/base lines, but the cloud remains neutral, hinting at possible short-term pullbacks prior to sustained growth[4].

- RSI and Momentum: ETH’s RSI levels (above 60 in some analyses) reinforce the bullish momentum, with targets revised to $1,850–$2,000 for April if buying pressure continues[3][5].

Market Mood

- Whale Swarm: Accumulation at lower price levels ($1,386–$1,800) suggests institutional interest, in harmony with ETF-driven optimism[3][4].

- Bearish Perils: Macroeconomic caution and failure to hold above $1,800 could unleash profit-taking, yanking Ethereum back to lower support zones[4].

Viewpoint

- April Forecast: AI models and experts converge around $1,800–$2,000 by month-end[3][5], conditional on breaching resistance.

- Mid-Year Forecasts: May and June predictions suggest $2,500–$2,900 if bullish technical patterns (e.g., ascending triangle) hold[3].

- Long-Term Potential: A breakout above $2,900 could ignite a 10x rally under favorable macro conditions, though this remains purely speculative[4].

In a nutshell, while recent momentum is bullish, investors are on the lookout for the $1,800–$2,000 zone for confirmation of a sustained uptrend.

- Shayan's analysis suggests that Ethereum's recent rally has been fueled by spot market buying, with the funding rates metric not yet displaying a notable increase, indicating that the bullish trend needs to be solidified with rising funding rates.

- The digital asset is currently trading within the challenging $1.8K resistance zone, a region of important order blocks and prior swing lows, where it is expected to undergo a short-term consolidation.

- Technology plays a crucial role in the world of cryptocurrency, as evidenced by the Ichimoku Cloud, which conveys a bullish convergence in the conversion/base lines but remains neutral, suggesting possible short-term pullbacks before sustained growth.

- Despite the mixed sentiments and short-term resistance, expert predictions generally agree that Ethereum could reach the $1,800–$2,000 zone by month-end, while mid-year forecasts point towards a potential increase to $2,500–$2,900, given that bullish technical patterns such as ascending triangles hold.

- In a favorable macro environment, a breakout above $2,900 could potentially lead to a 10x rally in Ethereum's price, although this remains largely speculative.