Exploring the Backbone of Kazakhstan's Progressive Open Banking Strategy

Kazakhstan's Push for Digital Payment Revolution: Open Banking and AI

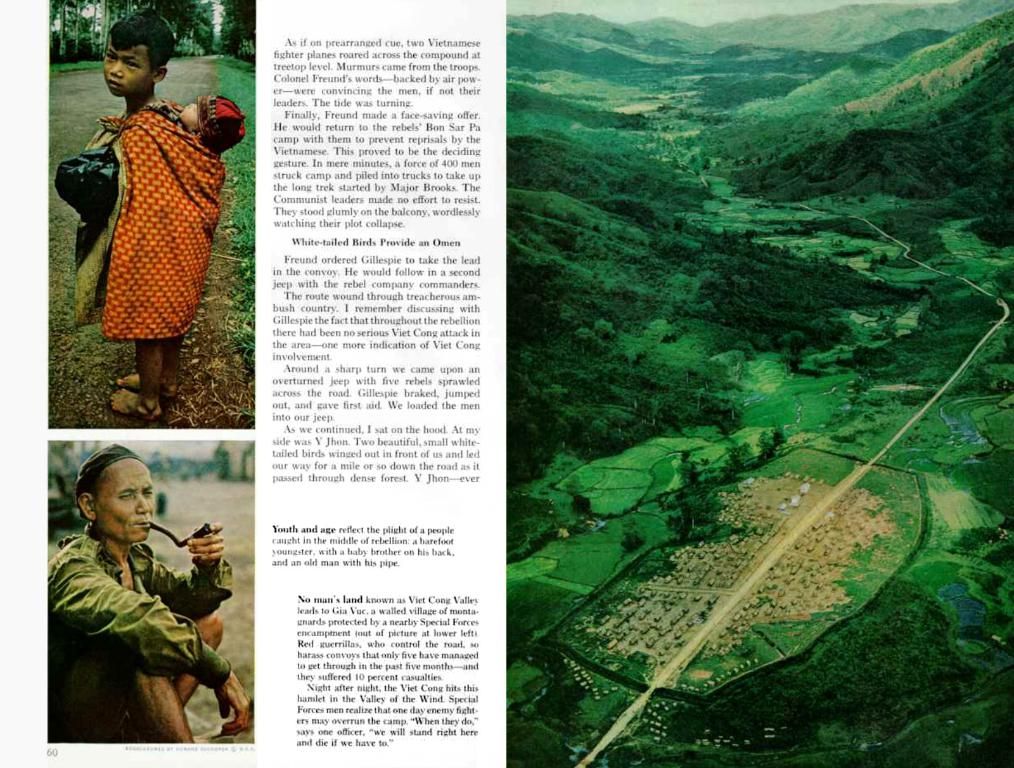

Welcome to the forefront of financial evolution, where Kazakhstan is leading the charge in digital payment reforms! Insights from Binur Zhalenov, a Chief Digital Officer at the National Bank of Kazakhstan (NBK), reveal the role open banking and artificial intelligence (AI) are set to play in transforming Kazakhstan's financial ecosystem.

Soddik Tursunov, a Bolashak scholarship recipient and Head of the National Payments Corporation, shares the limelight with Zhalenov in this digital transformation journey.

Unraveling Open Banking

At its core, open banking entails standardized exchange of financial information between various financial institutions and third-party providers, all with the customer's consent. This facilitated by Open API (application programming interfaces), enabling secure access to consumer data. The world is adopting open banking in over 100 countries, Kazakhstan among them.

Digital National Bank: A Blueprint for Change

Open banking is part of the NBK's broader strategy for a Digital National Bank, announced in 2024. With five central pillars, the initiative aims to create a comprehensive ecosystem around its central banking and supervisory functions.

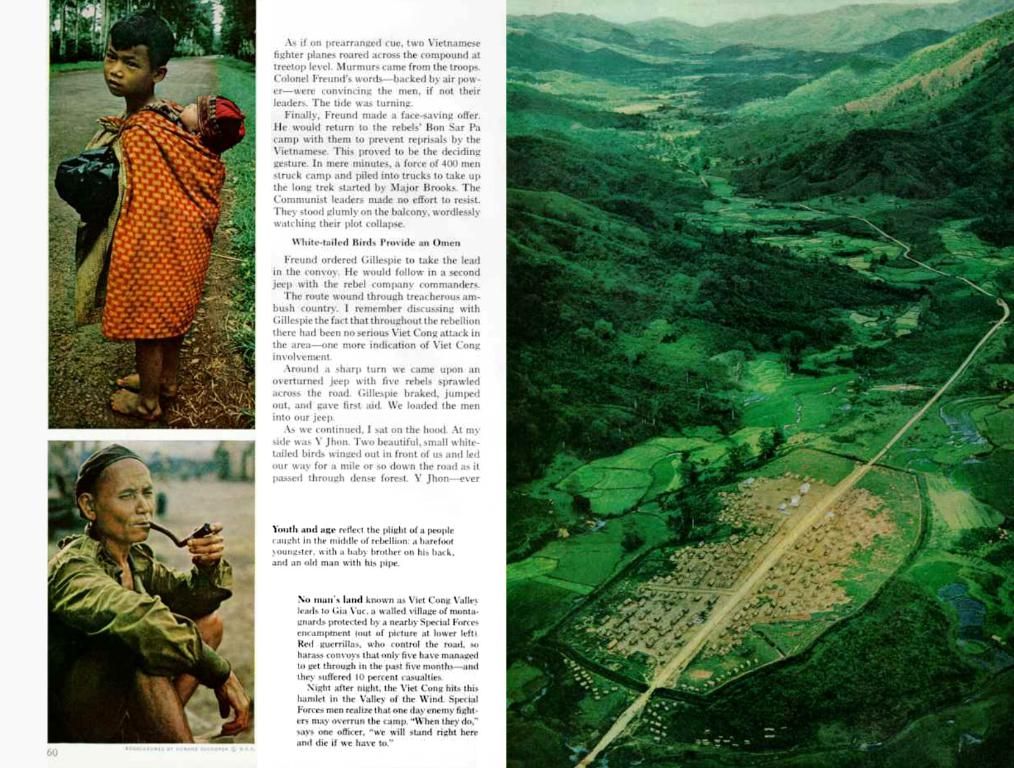

- National digital infrastructure: Establishing a digital infrastructure to support the seamless exchange of financial data among banks and consumers.

- Supervisory technology: Adopting AI and machine learning to enhance oversight of financial institutions, ensuring security and resilience.

- Data-driven central bank: Building a data factory to make informed decisions based on collected and analyzed data.

- Internal digital transformation: Encouraging the adoption of agile working practices within the NBK.

- Adoption of open banking and digital payments: Facilitating digital transactions and fostering competition within the financial ecosystem.

National Digital Financial Infrastructure: A Game-Changer

When asked about the national digital financial infrastructure, Zhalenov likened it to "roads between banks," allowing money to flow unhindered via digital "payment rails," represented by card payments, peer-to-peer transfers, and QR codes. The NBK is responsible for building these digital roadways.

Empowering Consumers

The end goal is to provide consumers with greater control over their financial affairs. By streamlining digital transactions, Kazakhstan aims to eliminate expensive and convoluted procedures associated with transferring funds between banks. As a result, competition within the market will intensify, driving innovation and pushing down fees.

Citizens will be able to switch banks easily, thanks to efforts surrounding open banking, and in turn accelerating competition in the market.

Open Banking in Action

Zhalenov's team is approaching open banking with a three-fold strategy: interbank payments, QR payments, and account aggregation.

- Interbank payments: Increasing the reach and reducing the cost of transfers between banks.

- QR payments: Expanding the interoperability of payment terminals, enabling users to make payments across different banking applications.

- Account aggregation: Allowing users to consolidate their financial information from multiple banks in a single mobile banking app. This will enhance flexibility and increase competition within the market.

A Data-Protected Future

In an era where data privacy is paramount, Zhalenov assures that the NBK is addressing concerns through two primary methods—stronger regulation and cutting-edge technology. A new banking law currently in the works will include a dedicated chapter on data privacy and protection.

Fraud Prevention

An Anti-Fraud Center, launched by NBK in 2024, serves to protect the financial sector against fraudulent activities. Powered by information-sharing between banks and law enforcement agencies, the center also maintains a central database of all reported fraud-related cases.

AI: A Transformative Force

Artificial Intelligence is poised to revolutionize the fintech sector, and its applications in Kazakhstan's financial landscape will be no exception. The NBK is working on 55 AI use cases, including chatbot solutions and advanced tools for capital flow monitoring, compliance, and fraud prevention.

AI has already begun making its presence felt in financial supervision, as evidenced by the Agency for Regulation and Development of Financial Market's implementation of SupTech solutions. With over 1,200 market participants under supervision, AI could significantly streamline data management and risk identification.

The Future: Personalized Finance

The application of advanced technologies is predicted to render financial services more personalized and tailored to each consumer's needs. In the future, banks will offer personalized financial products to consumers, shifting away from the traditional one-size-fits-all model.

Stay tuned for the full interview with Binur Zhalenov, coming soon on The Astana Times YouTube channel! Stay informed!.

- Kazakhstan, under the guidance of Binur Zhalenov and Soddik Tursunov, plans to achieve a digital payment revolution by implementing open banking and artificial intelligence (AI) to transform its financial ecosystem.

- In the Digital National Bank's strategy announced in 2024, open banking plays a crucial role alongside five central pillars: national digital infrastructure, supervisory technology, data-driven central bank, internal digital transformation, and adoption of open banking and digital payments.

- Zhalenov and his team are implementing a three-fold strategy for open banking: interbank payments, QR payments, and account aggregation, which aims to increase competition and streamline digital transactions.

- As Kazakhstan adopts open banking, consumers will have greater control over their financial affairs, reducing complexities and costs associated with transferring funds between banks, while enhancing data privacy and protection through stronger regulation and advanced technology.