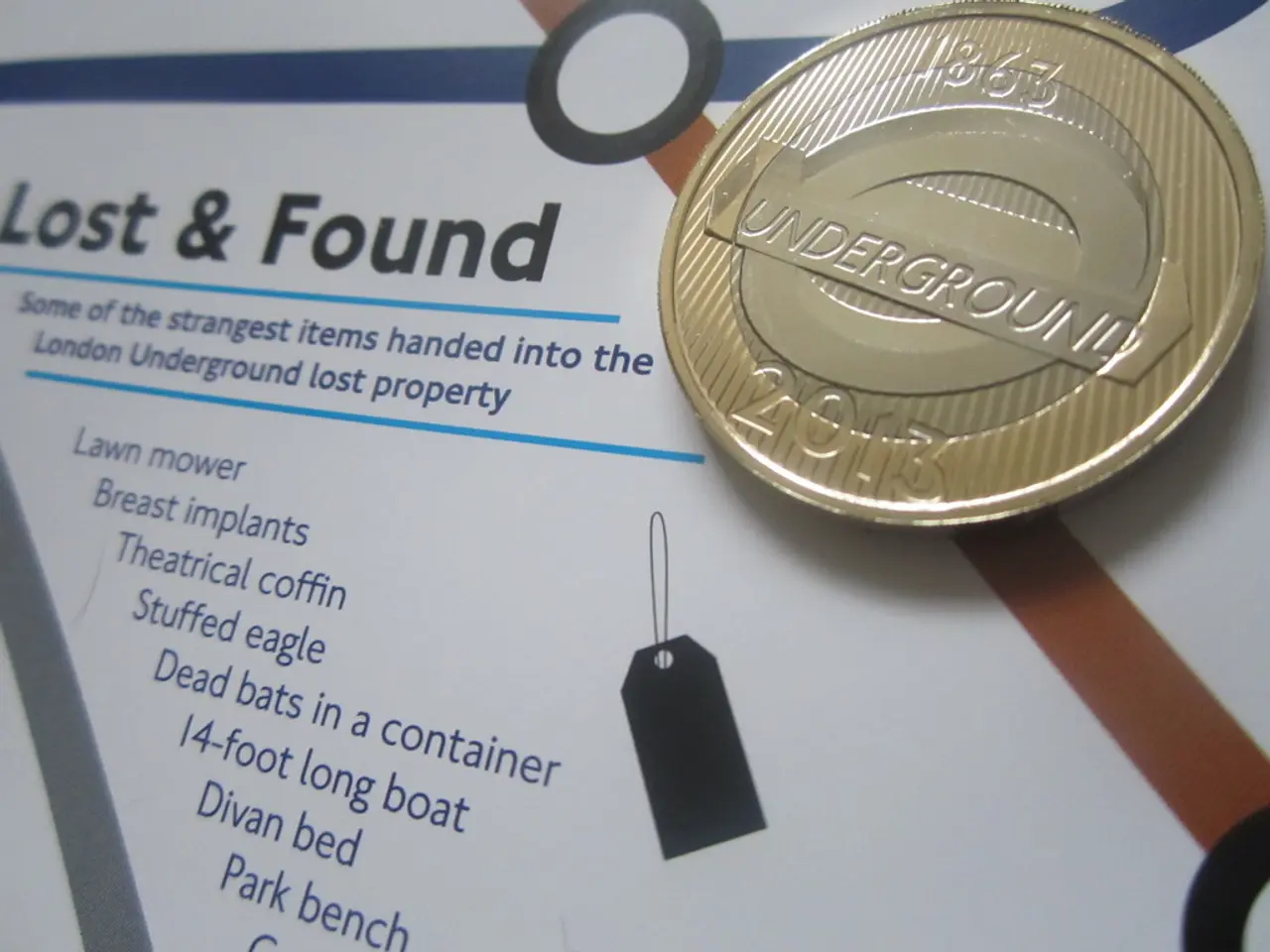

Held onto 300 Bitcoins for a decade, resulting in a remarkable yield of more than 20,000%

In a significant move that has sent ripples through the cryptocurrency market, a Bitcoin whale, who has been holding 300 BTC since 2014, has recently moved these coins to sell them for Ethereum (ETH). This strategic shift marks a growing interest in Ethereum, as the whale seeks to capitalize on its more attractive funding rates, staking yields, and DeFi growth opportunities compared to Bitcoin.

The whale, who already holds 14,837 BTC (approximately $1.6 billion) and has been actively converting BTC into ETH, has increased its leveraged and spot ETH holdings significantly. With a total ETH exposure now exceeding 257,000 ETH, the whale stands to gain unrealized profits over $100 million.

Market Impact

This move by the whale is being closely watched by analysts, who believe it signals a possible institutional preference shift towards Ethereum for better risk-adjusted returns. The high-value ETH spot and leveraged long positions generated by this transaction could potentially increase ETH market liquidity and influence price movements on platforms like Hyperliquid. Traders tracking such large moves may interpret this as bullish for ETH relative to BTC, affecting short-term market sentiment and trading behavior.

A Notable Event

The awakening of this crypto whale after 11 years of inactivity is a notable event that underscores the importance of maintaining an informed and long-term perspective for new investors. The strategy of holding onto Bitcoin for a long period, known as "HODL" in the crypto community, is recommended for those with high risk tolerance and confidence in the technological development of the blockchain ecosystem.

Crypto Market Volatility

The mobilization of funds by large crypto holders often coincides with significant events like halvings, regulatory changes, or macroeconomic movements. Mass selling by crypto whales can cause temporary price drops, highlighting the inherent volatility of the crypto market. Timing the market is difficult, but disciplined and gradual accumulation can help mitigate risks and take advantage of natural market cycles.

Bitcoin's Long-term Bullish Trend

Despite this significant transaction, Bitcoin's long-term bullish trend remains. In 2017, the price of Bitcoin broke the $1,000 barrier and reached a historic high near $20,000 at the end of the year. Institutional adoption and global events like the COVID-19 pandemic pushed Bitcoin's price up again, exceeding $60,000 in 2021.

The price of Bitcoin was around $440 per unit when the individual who sold their 300 BTC made the acquisition in 2014. Today, those same 300 Bitcoins are worth over $31 million, reflecting a return of over 20,000%. This underscores the potential rewards, as well as the risks, associated with investing in cryptoassets.

Investing in cryptoassets carries a high risk of losing the entire amount invested due to its volatility, and may not be suitable for retail investors. Analysts closely follow the signals from large crypto holders to anticipate possible trends, but it's essential for investors to conduct their own research and make informed decisions based on their risk tolerance and investment goals.

[1] CoinDesk (2021). "Bitcoin Whale Sells 300 BTC for Ethereum, Signaling Institutional Shift." [online] Available at: https://www.coindesk.com/business/2021/03/01/bitcoin-whale-sells-300-btc-for-ethereum-signaling-institutional-shift/

[2] Decrypt (2021). "Bitcoin Whale Sells 300 BTC for Ethereum: What It Means for the Market." [online] Available at: https://decrypt.co/53625/bitcoin-whale-sells-300-btc-for-ethereum-what-it-means-for-the-market

[3] Finance Magnates (2021). "Bitcoin Whale Selling 300 BTC for Ethereum: What Does It Mean for the Market?" [online] Available at: https://financemagnates.com/cryptocurrency/news/bitcoin-whale-selling-300-btc-for-ethereum-what-does-it-mean-for-the-market-/

[4] The Block (2021). "Bitcoin whale sells 300 BTC for Ethereum." [online] Available at: https://www.theblockcrypto.com/post/86421/bitcoin-whale-sells-300-btc-for-ethereum

[5] Cointelegraph (2021). "Bitcoin whale sells 300 BTC for Ethereum, as BTC's dominance continues to shrink." [online] Available at: https://cointelegraph.com/news/bitcoin-whale-sells-300-btc-for-ethereum-as-btc-s-dominance-continues-to-shrink

Technology and its influence on finance are evident as a Bitcoin whale, known for holding 300 BTC since 2014, has recently chosen to sell these coins for Ethereum (ETH). This strategic decision for Ethereum may indicate a growing interest in its higher-yielding DeFi growth opportunities compared to Bitcoin, as well as more attractive funding rates. The shift in investing preferences could have significant implications for the cryptocurrency market, especially when considering the whale's substantial ETH holdings worth over $100 million. This move emphasizes the importance of staying informed about market trends, technology advancements, and their potential impact on financial decisions.