PredictedBroadband Expansion, Secure Dividend Distribution, Earnings Yield of 8% for AT&T

AT&T's Q1 Performance – The Telecom Titan's Steady Progress

AT&T Inc. (NYSE:T) disclosed its mixed first quarter earnings, showcasing the telecommunications bigwig's steady advancement in debt repayments and expanding its broadband customer base. Contrary to predictions, AT&T hasn't shown signs of a major sell-off yet.

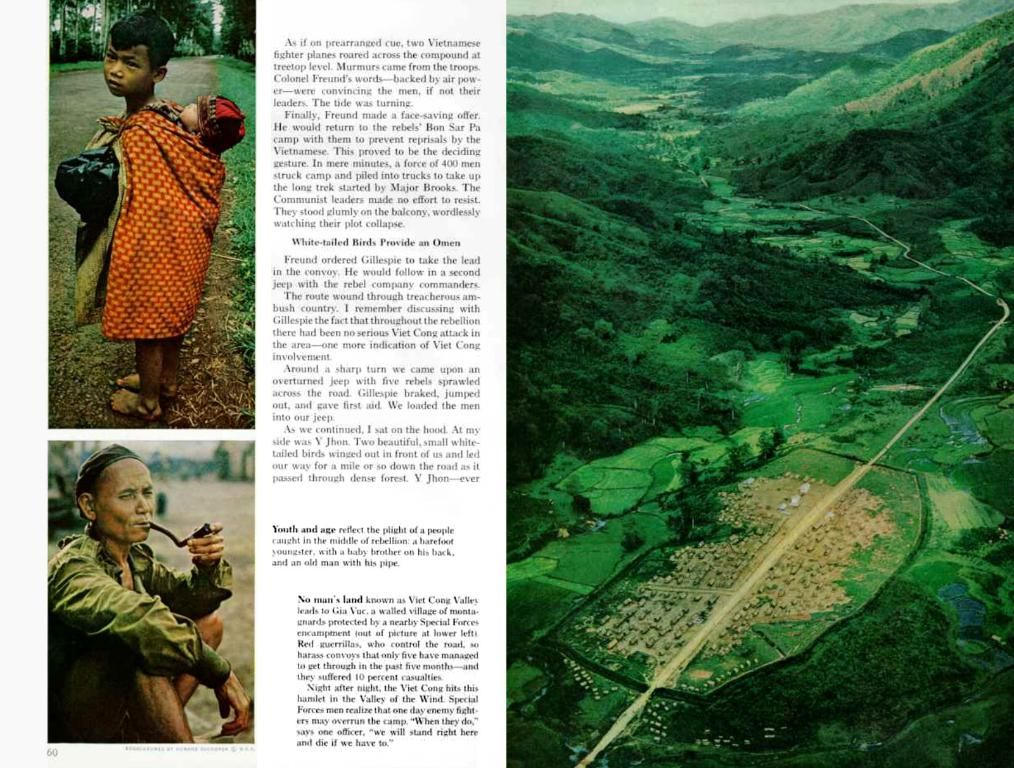

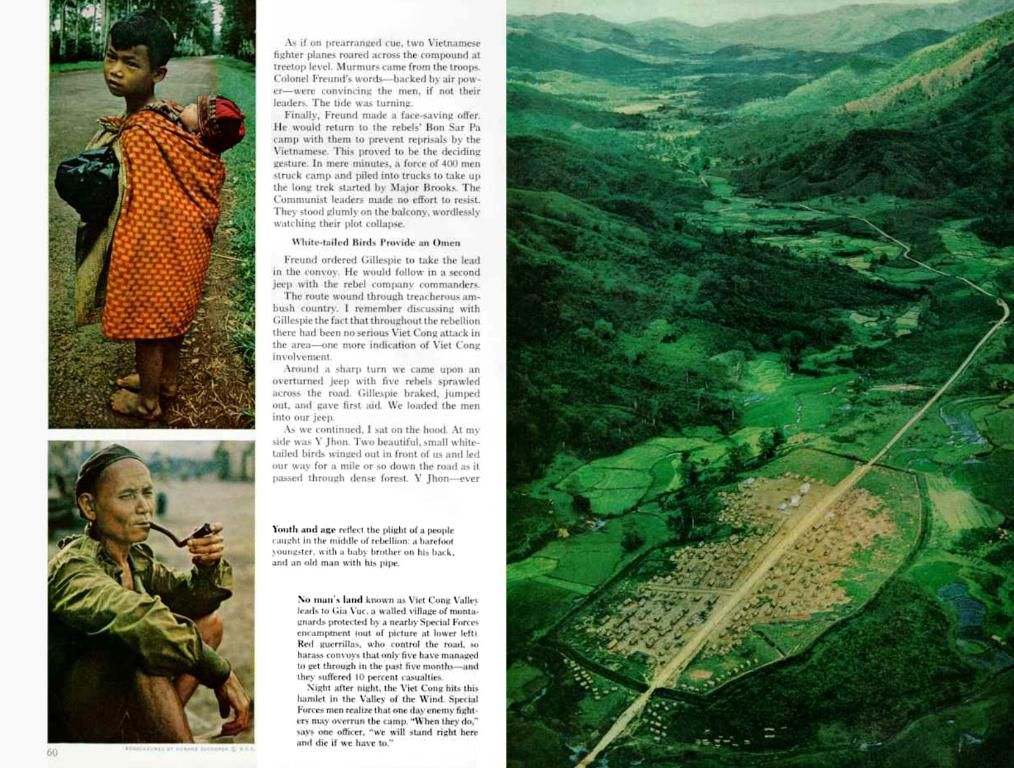

Broadband's Rising Tide

AT&T's fiber dominance continues to soar, with a whopping 261,000 new AT&T Fiber customers added in Q1 2025. This marks the 21st consecutive quarter with over 200,000 fiber net additions! The total fiber subscriber count now stands at a staggering 9.6 million customers.

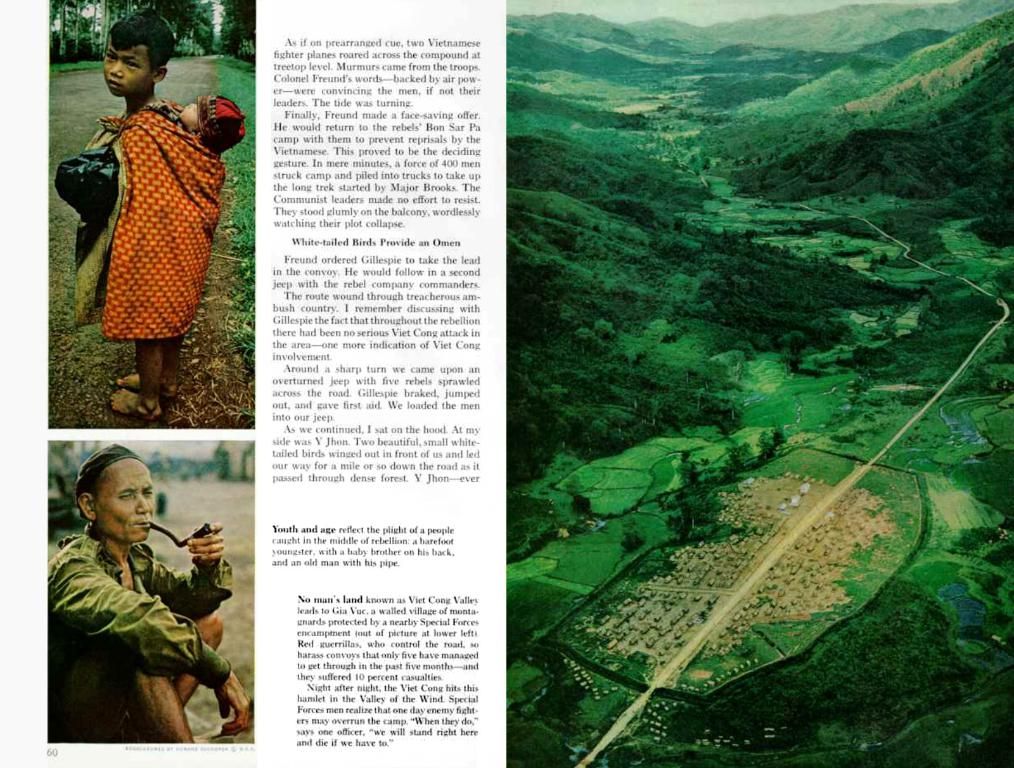

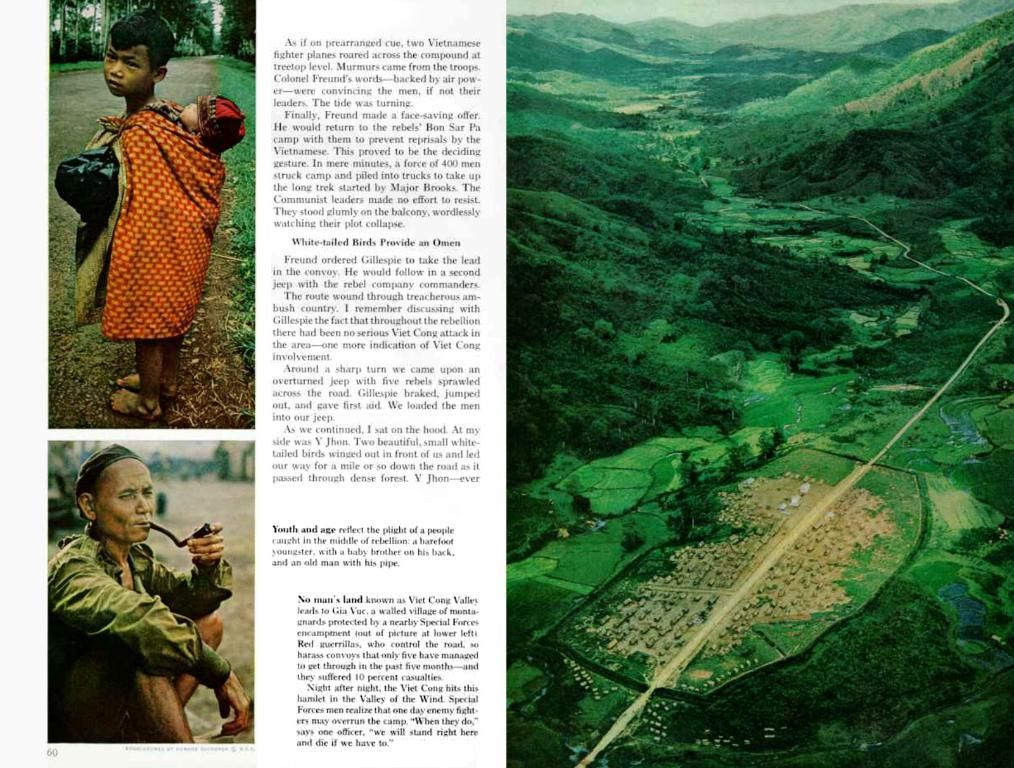

Expansion of fiber networks is a top priority for AT&T. As of Q1 2025, the company has reached 29.5 million locations, aiming to surpass 30 million locations by mid-2025! Their ultimate goal is to connect over 50 million locations with fiber by 2029, primarily through organic growth and commercial open-access fiber agreements.

Revened from consumer fiber broadband services surged by an impressive 19% year-over-year to $2.1 billion. This growth was driven by customers upgrading to faster service tiers, with the average revenue per user (ARPU) rising by 7.4% to $70.87. Fiber-specific ARPU saw a 6.2% jump as well. It's not surprising that more than 40% of AT&T Fiber households subscribe to AT&T wireless services, representing the company's strategy to cross-sell services and strengthen customer relationships.

Postpaid phone subscribers expanded too, with an addition of 324,000 users in Q1 2025. The postpaid phone churn rate was impressively low at 0.83%, indicating rock-solid subscriber loyalty.

Debt Repayment and Financial Stability

AT&T reconfirmed its 2025 outlook:

- Single-digit service revenue growth

- Mobility service revenue growth at the upper end of 2% to 3%

- Mid-teens percentage range consumer fiber broadband revenue growth

- Adjusted EBITDA growth of at least 3%

- Free cash flow of $16 billion or more

- Capital investment of around $22 billion

- Adjusted earnings per share between $1.97 and $2.07 for the whole year

AT&T's projected free cash flow puts it in a solid financial position, enabling ongoing debt repayment and capital investment focused on fiber and 5G network expansion.

The solid Q1 financial results, including a 6.3% rise in adjusted EPS and 4.4% growth in adjusted EBITDA to $11.5 billion, sparked positive stock market reactions, underpinning investor confidence in AT&T's strategic vision.

All in all, AT&T persists in its momentum to expand its broadband customer base, particularly in fiber, while maintaining a financially sound footing that supports debt repayment and future network expansion investments. The fiber milestones are ahead of schedule, fueled by synergy with mobility services, and AT&T aims to sustain this growth throughout 2025 and beyond.

- AT&T Inc. – First Quarter 2025 Earnings Presentation

- AT&T Falls a Penny Short of Analyst Expectations for Q1 Earnings

- AT&T Q1 Earnings: Growing Broadband Subscriber Base, Debt Repayment Progress

- AT&T Q1 Earnings: Strong Financials Support Solid Dividend

- On Wednesday, AT&T Inc., the leading player in telecommunications and technology, announced its Q1 earnings, displaying progress in debt repayments and a growing broadband customer base.

- Despite some predictions suggesting a significant sell-off, AT&T's Q1 earnings revealed no substantial signs of a major downfall, despite the mixed results.

- In the financial sector, the positive stock market reactions following AT&T's Q1 results reflect investor confidence in their strategic vision, particularly their focus on expanding broadband subscribers, especially in fiber.

- As part of its ongoing commitment to investment in fiber and 5G network expansion, AT&T's projected free cash flow from Q1 2025 puts the company in a strong position to support ongoing debt repayment.