Rockin' the Onchain Economy: VanEck's NODE ETF

SEC Grants Approval for VanEck to Introduce NODE, Centered on Stocks Tied to Cryptocurrencies

Get ready to dive into the digital gold rush with VanEck's brand new fund, the Onchain Economy ETF, ticker symbol NODE! This beauty is set to launch on May 14, 2025, and it's here to shake up the crypto game. Matt Sigel, VanEck's boss man of digital assets research, is steering the ship on this one.

NODE is all about giving investors a piece of the action in the real-world companies sprouting roots in the crypto cosmos. Unlike your run-of-the-mill Bitcoin or Ethereum ETFs, NODE avoids the trouble of holding cryptocurrencies themselves. Instead, it's all about investing in 30 to 60 public stocks across various sectors. This crypto alchemy includes mining operations, exchanges, hardware manufacturers, gaming realm, and infrastructure providers, plus traditional finance giants and energy/data center providers.

To add a bit more diversity to the mix, NODE can allocate up to 25% of its portfolio to other crypto-related ETFs. That's a clever move to lock in some indirect crypto exposure without getting stuck holding the digital coins themselves.

As Matt Sigel puts it, "The global economy is branching out on a digital limb, and NODE is a means of sinking your teeth into the businesses constructing that future."

VanEck has already got its hands dipped in the blockchain arena with ETFs dedicated to Bitcoin and Ethereum, and they're waiting with bated breath for the regulatory green light on Solana (SOL) and Avalanche (AVAX) ETFs.

In the wider ETF world, the SEC approved spot Bitcoin ETFs in January 2024, unleashing a flood of investments. Later that year, Ethereum also joined the party. Meanwhile, Franklin Templeton and Hashdex teamed up to birth a combined BTC-ETH fund, providing a symbiotic exposure to both crypto heavyweights.

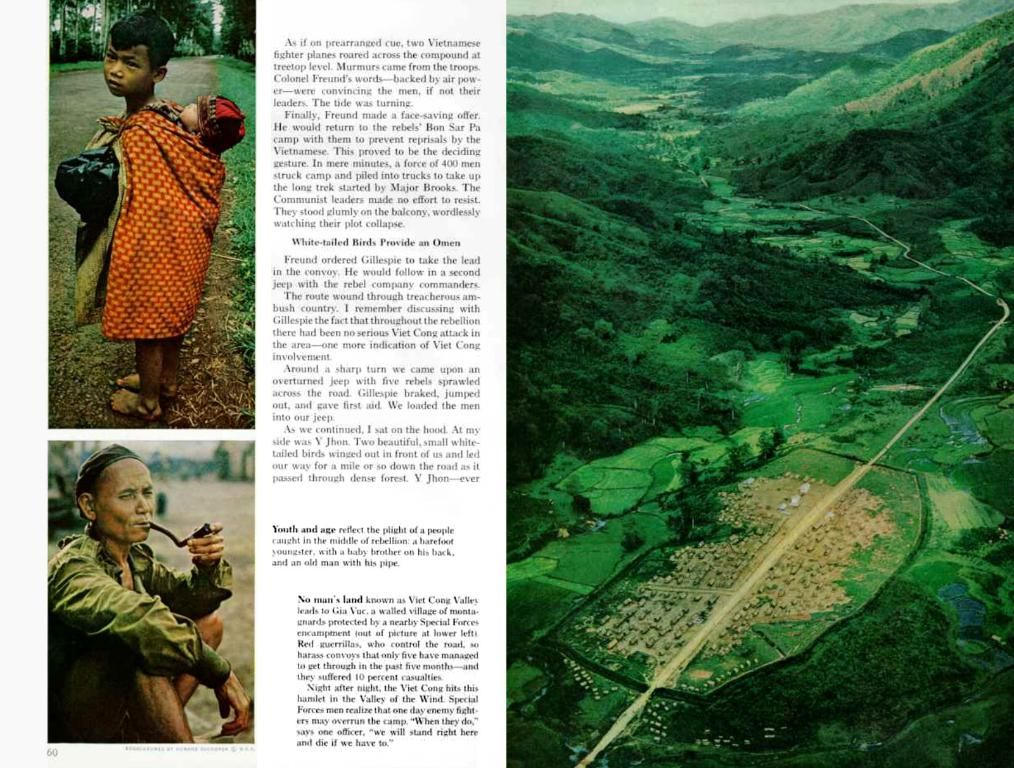

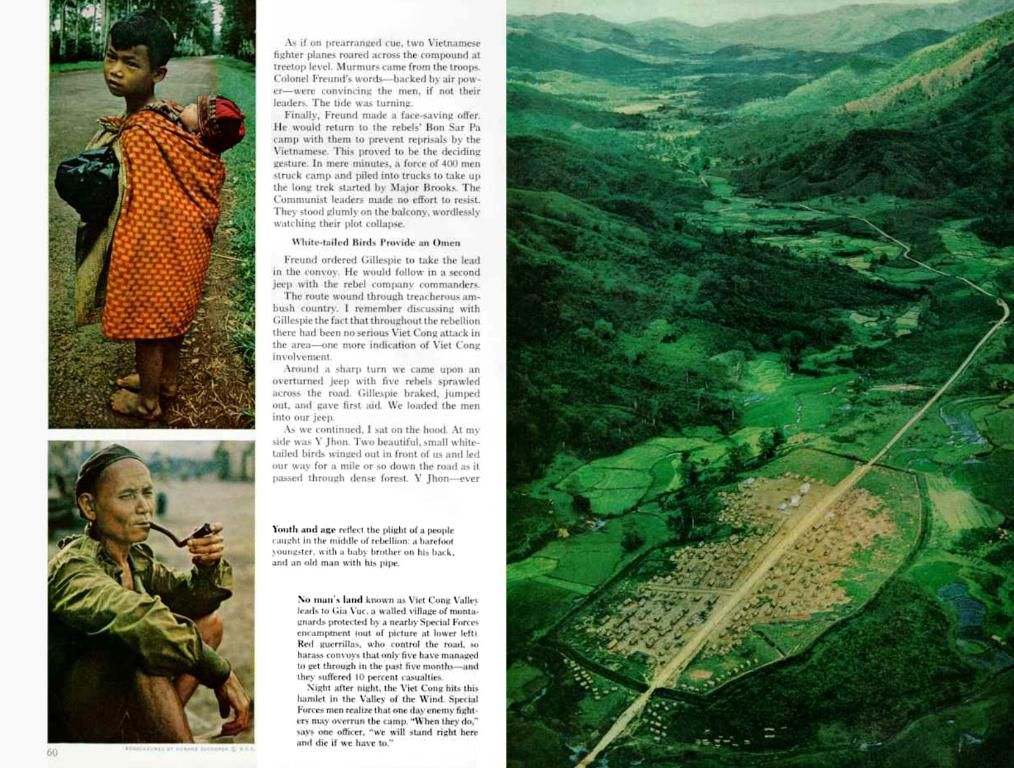

So buckle up and get ready to ride the digital revolution with VanEck's NODE ETF! It's gonna be a wild ride!

Important Facts:

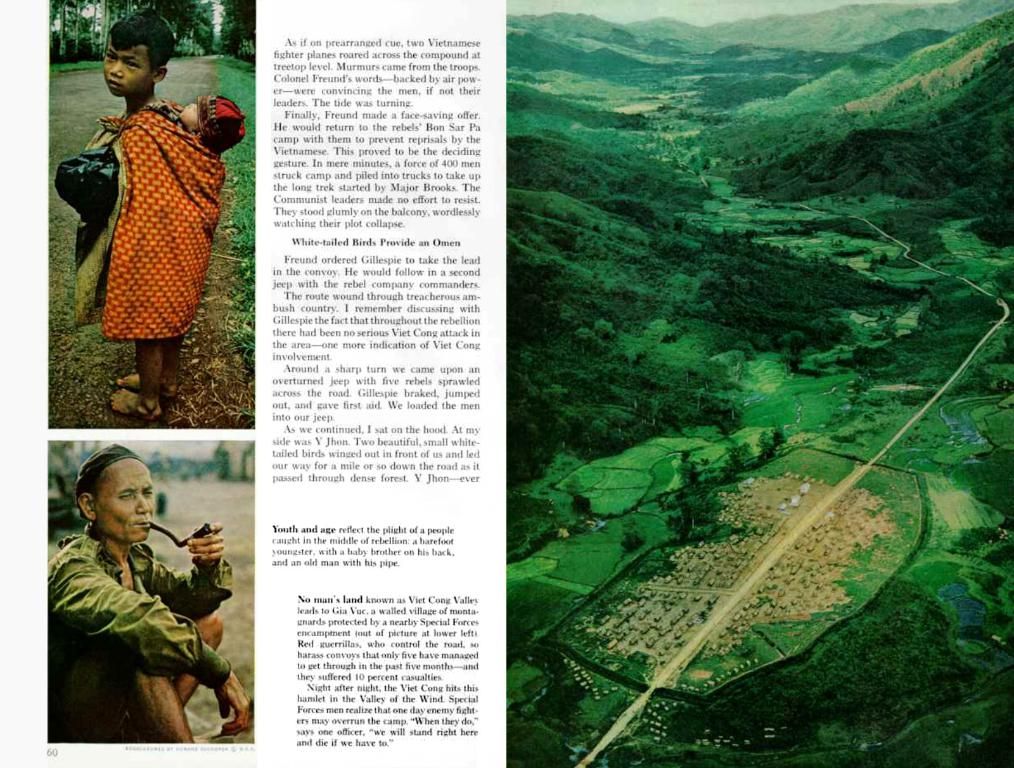

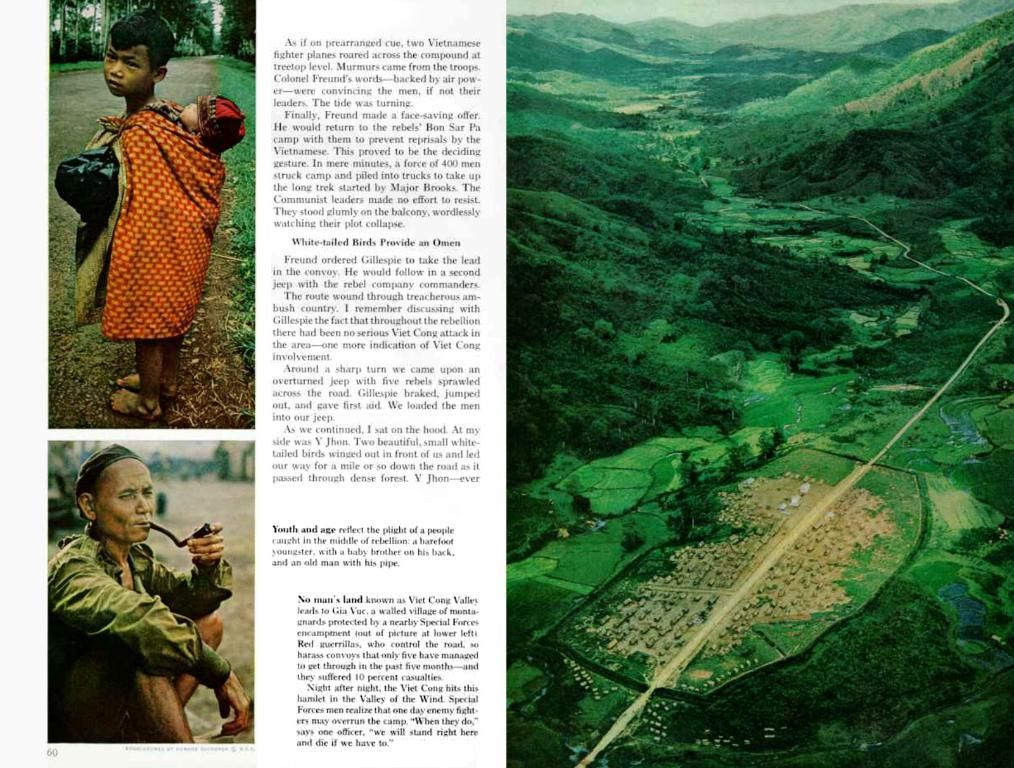

- Launch Date: May 14, 2025

- Ticker: NODE

- Active Management: Matt Sigel, Head of Digital Assets Research, VanEck

- Indirect Crypto Exposure: Portfolio can allocate up to 25% to other crypto-related ETFs

- Diversification: Invests across multiple sectors related to digital assets for broader economic exposure

- Regulatory Compliance: Investment strategy avoids direct cryptocurrency holdings and regulatory hurdles

Insights:

- Investment Strategy: By investing in equity holdings and utilizing derivatives for indirect crypto exposure, NODE offers an innovative approach to investing in the digital asset ecosystem without directly holding cryptocurrencies.

- Regulatory Compliance: The ETF's investment strategy sidesteps regulatory issues associated with direct spot cryptocurrency investments in traditional crypto ETFs.

- Diversification: By investing across multiple sectors, NODE provides a broader economic exposure compared to traditional cryptocurrency ETFs, which often have a concentrated investment approach.

- Global Expansion: The launch of NODE reflects a growing trend of mainstream financial institutions entering the digital asset space and catering to investor demand for crypto-related products.

- Investors can unlock the potential of the digital gold rush with VanEck's NODE ETF, set to launch in May 2025, providing a unique opportunity to invest in real-world companies linked to the crypto cosmos.

- Matt Sigel, head of digital assets research at VanEck, will steer the NODE ETF, which although not directly investing in cryptocurrencies, can allocate up to 25% of its portfolio to other crypto-related ETFs for indirect exposure.

- Joining VanEck's crypto-focused ETFs like Bitcoin and Ethereum, NODE will offer diversified investing across multiple sectors related to digital assets, including mining operations, exchanges, and traditional finance giants.

- The regulatory-compliant investment strategy of NODE, unlike traditional crypto ETFs, avoids direct cryptocurrency holdings and provides a broader economic exposure, reflecting the global trend of mainstream financial institutions venturing into the digital asset space.