Tech Experts Suggest Microsoft Shares Serves as a 'Safe Haven' for Tech Investors. Is It Wise to Invest in MSFT Immediately?

Microsoft's Q3 Earnings Smash Expectations, Setting Sights on Future AI Dominance

Amidst ongoing economic turbulence, Microsoft (MSFT) has left the competition in the dust with an exceptional third-quarter earnings report - the cherry on top of a challenging fiscal 2025 so far. The company's cloud business, fueled by scorching demand for artificial intelligence (AI) services, has been a game-changer.

Following the stellar announcement, investors couldn't contain their excitement, sending MSFT shares soaring by nearly 7.6% the following day. Although the stock hasn't shown dizzying gains in 2025, optimism remains sky-high on Wall Street.

Beating the Odds: One Step Ahead of Retailers with AI

Oppenheimer has rightfully commended Microsoft's stellar quarterly performance, with the growing momentum in Azure and AI reinforcing the tech giant's strategic edge in enterprise IT. The firm believes Microsoft's extensive presence across productivity solutions sets it apart in the retail sector, addressing problems retailers may not even know they have.

With Microsoft's footprint across the retail landscape, Oppenheimer sees the tech titan as a relatively "safer harbor" amidst the turmoil in the software sector.

The King of Computing

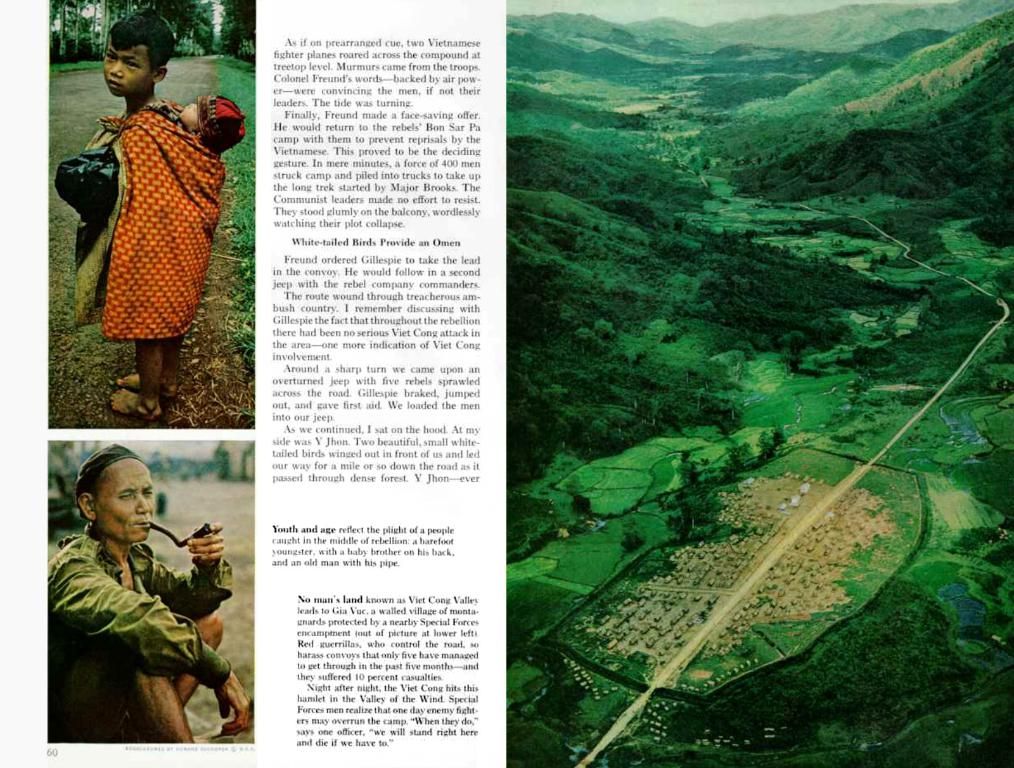

Hailing from Redmond, Washington, Microsoft towers over the tech world with an 80% share of the global PC operating system market. Its Microsoft 365 suite continues to redefine productivity, assisting businesses and individuals worldwide.

Over the past 52 weeks, MSFT has racked up a gain of 9.3%. Currently, the stock stands at 30.3 times forward adjusted earnings and 12 times sales, indicating a premium against peers. However, when compared to its five-year average multiples, it appears to be an enticing proposition.

Azure Powers Microsoft's Q3 Earnings Surge

On April 30, Microsoft reported its fiscal 2025 third-quarter earnings, surpassing analyst estimates by a wide margin. Revenue hit $70.07 billion, marking a 13% increase year-over-year. Azure and other cloud services, once again, served as the linchpin, registering a 33% year-over-year surge that quickly outpaced even company guidance.

Microsoft's profitability was equally impressive, as operating margins reached 45.7% (up 108 basis points from the previous year) and net income soared to $25.8 billion ($3.46 per share). This handily exceeded the Street's expectations of $3.22 per share.

Looking ahead to Q4, Oppenheimer predicts Azure to grow 34% to 35% in constant currency, with Intelligent Cloud revenue targeted between $28.75 billion and $29.05 billion - both figures beating street expectations. The Productivity and Business Processes segment is expected to generate between $32.05 billion and $32.35 billion, again surpassing consensus estimates.

Despite a few minor hiccups (such as increased capital expenditures and slow growth in consumer Microsoft 365 seats), the overall outlook for Microsoft remains favorable. The company emphasized its ability to expand its footprint in the hyperscale market and capitalize on the ongoing generative AI cycle.

As for earnings expectations, Street forecasts Microsoft's EPS to grow 11.9% in Q4 to $3.30. For the full fiscal year 2025, EPS is expected to climb 10.9% year-over-year to $13.09. The growth trajectory remains strong, with EPS estimates for fiscal 2026 pointing to a 12% increase, reaching $14.66.

Wall Street's Juicy MSFT Prognosis

Wall Street is abuzz with optimism, and it shows. Microsoft has earned an overall "Strong Buy" consensus across analysts, with a staggering 71% of tracked analysts urging "buy" or similar ratings. The average price target is approximately $507.77, with forecasts ranging from $476 to $575, according to various sources. This level of agreement speaks volumes in a market often influenced by whispers.

- Microsoft, with its significant presence in enterprise IT and the growing momentum in Azure and AI, has earned plaudits from Oppenheimer, setting it apart in the retail sector by addressing problems that retailers may not even be aware of.

- The digital titan, Microsoft, has been commended for its bullish quarterly performance, as it holds a formidable 80% share of the global PC operating system market.

- Oppenheimer sees Microsoft's vast presence across the technology landscape as a relatively "safer harbor" amidst the software industry's turbulence.

- Azure, a key component of Microsoft's cloud services, has been instrumental in the company's exceptional third-quarter earnings report, registering a substantial 33% year-over-year surge.